Welcome to the latest edition of The Road to 2030 by Autotrader

The Road to 2030 Report tracks the progress of electric vehicle (EV) adoption in the UK using bespoke data and insights from Autotrader, the UK’s largest automotive marketplace.

The latest edition of the Report dives into market dynamics of the new and used electric sectors, exploring what’s working and where support is needed.

Published 16th February 2026

Opening remarks from Ian Plummer, Chief Customer Officer.

2025 was another record year for electric vehicles (EVs) with just under half a million electric car registrations – about one in four of new cars sold. Whilst any progress is good, these numbers still aren’t meeting Government targets, although flexibilities introduced in 2025 have dampened the potential impact of this, and December was the only month to exceed the ZEV Mandate of 28% of new car sales.

The previous Road to 2030 Report in July 2025 shone a light on the impact of those changes to the ZEV Mandate announced in April last year, these included lower penalties for not meeting targets and extended flexibilities in the credit system. These changes resulted a reduction in the aggressive level of discounts on EVs as Manufacturers faced less pressure to stimulate demand by now targeting towards a share of EV sales slightly lower than the headline mandate targets.

Since then, the Government launched the Electric Car Grant (ECG) – the impact of which we’ll explore in this Report. Just a few months after the launch of the Grant, electric Vehicle Excise Duty – the fuel duty replacement – was announced in the Autumn budget, creating mixed messaging at a time when consistency is vital.

While regulatory pressures have been a key driver of the UK transition, the growth of competition has been an equally strong force. We’ve seen the brand landscape continue to change with more affordable electric models in the UK, which have come from both the launch of new entrant and well-established brands – there are now 72 brands in the UK, up from circa 45 in 2019. This Report will explore the impact of these forces and delve into the ever-evolving market dynamics of the new and used electric markets in the UK.

Consumer interest in EVs on Autotrader grew more than a quarter in 2025

Total views of both new and used electric adverts were up 28%, with enquiries sent to retailers about EVs up 27% compared to 2024.

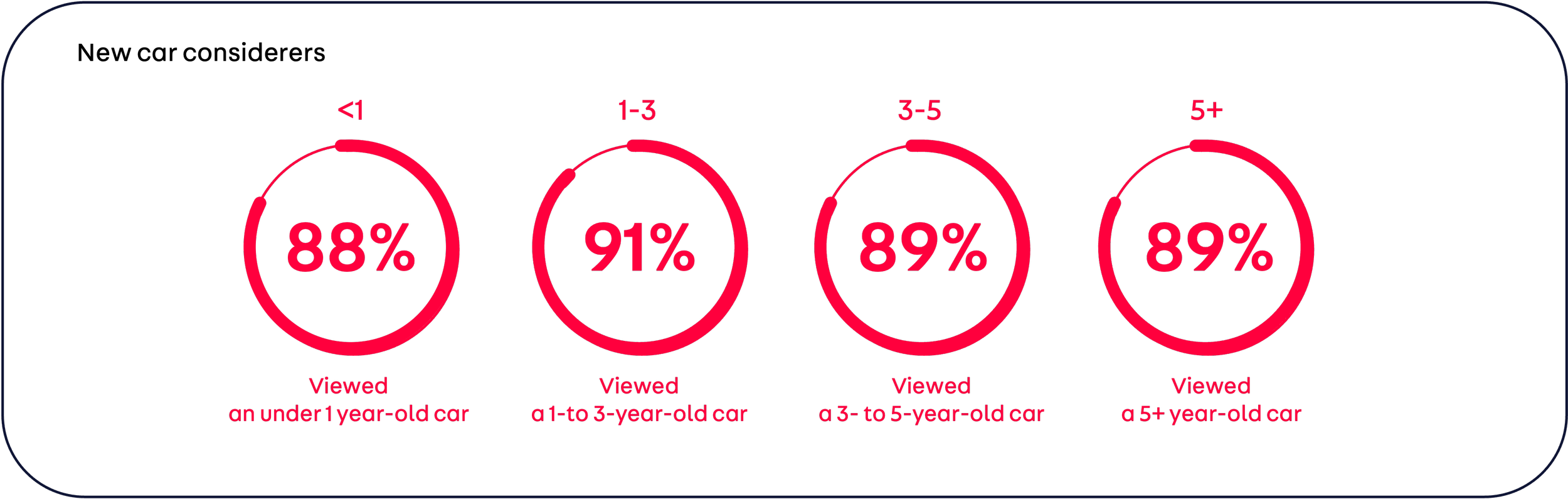

On Autotrader, consumers are cross-shopping between new and used EVs with 90% of new EV considerers also considering used options:

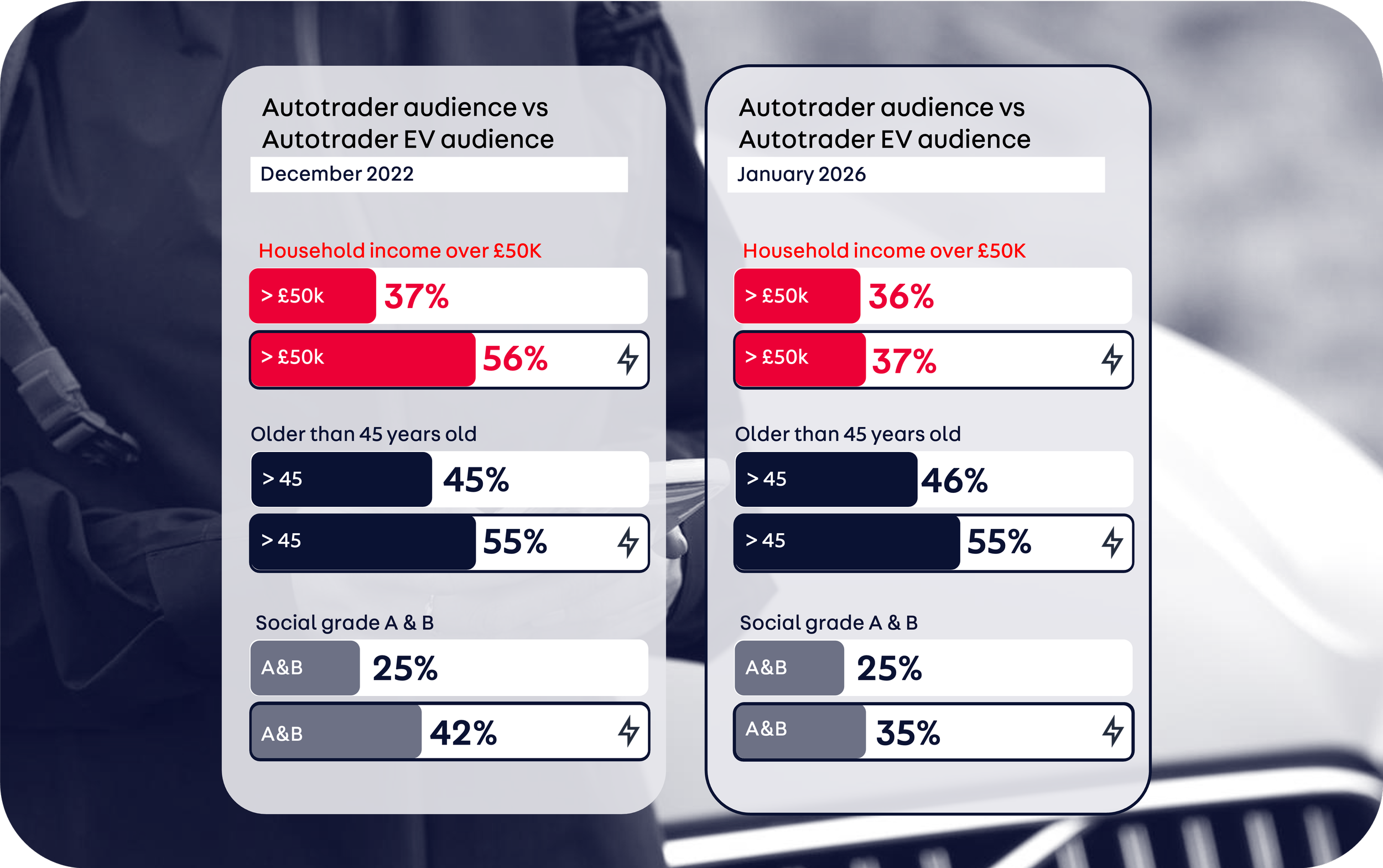

As affordability improves, demographics of EV considerers are changing

Upfront price has historically been the number one barrier to electric adoption and as this reduces – the upfront electric premium on a new car is now 17%, almost half of 2024 levels – more people are able to make the switch.

The Autotrader electric audience used to be significantly different to the overall Autotrader audience - older and more affluent - but these gaps have reduced significantly:

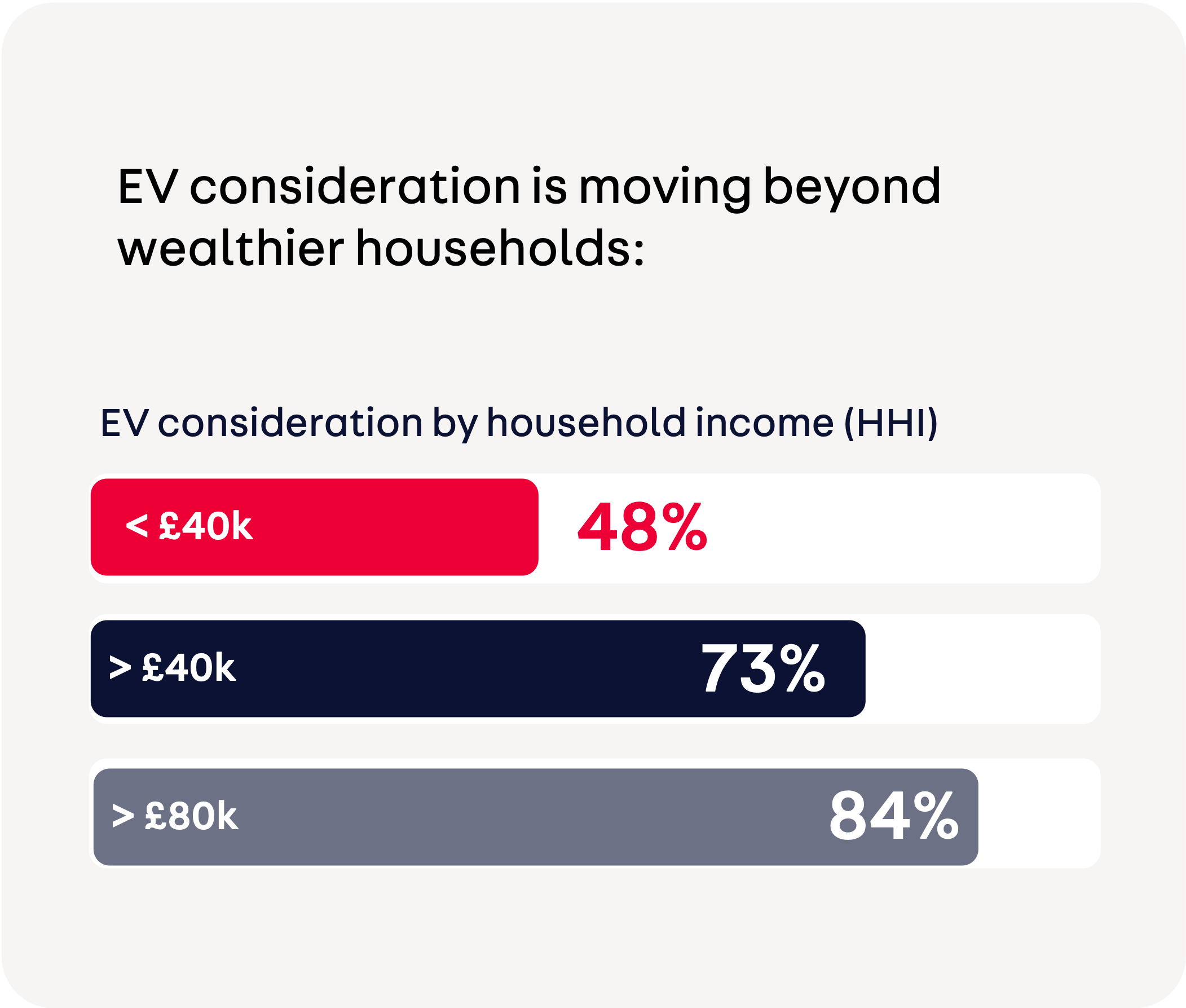

However, whilst EV consideration is moving beyond the wealthier in society, many are still at risk of being left behind

As explored in our No Driver Left Behind Report: Bridging the EV income gap, 62% of the population would now consider an EV for their next car, up from 34% in 2024. While growing consideration is good news, it will take a while for consideration to filter through to purchase and for this to shift the needle of mass adoption.

And whilst affordability has improved significantly, upfront price still is - and will continue to be - a key barrier for many.

For households earning less than £40,000, consideration drops to less than half (48%) whilst households earning above £80,000 have much higher consideration at 84%.

With time, large scale availability of affordable used EVs will grow- 60% of the lower income group spend less than £10,000 on their cars. But in the meantime, there’s no support for lower income households specifically to access used EVs in their price bracket. Currently just 5% of all used electric stock on Autotrader is under £10,000, compared to 35% of petrol stock.

For a deeper dive on this issue and suggested solutions, read our latest No Driver Left Behind Report: Bridging the EV income gap

Improved affordability in the new electric market has resulted in steady growth in interest

In another record year for new electric car registrations, almost one in four new cars registered were electric:

On Autotrader, electric vehicles’ share of advert views grew five percentage points in 2025, with an annual average of 22%. The share of enquiries sent to retailers about new electric cars grew four percentage points to 21%.

Efforts from the industry to address the upfront price difference by expanding product ranges to cheaper vehicle segments and implementing technological advancements have contributed to this growth in new EV interest.

However, this steady growth is not sufficient at this point in the transition, and the pace needs to pick up. Notably, interest levels today – in the third year of the ZEV Mandate – are far below from the spikes in interest that followed surges in fuel prices in 2022.

Affordable models were the most in demand in 2025

The best performing EVs on Autotrader were among the most affordable choices, with notably lower prices than some models no longer featured.

Consumer demand shifted in favour of vehicles priced competitively or close to parity with their combustion engine counterparts, showing that when one of the major barriers to adoption is reduced, uptake improves.

More affordable arrivals should continue to support interest in 2026

As the used electric market matures, market dynamics are shifting.

Demand for used EVs up to 6-years-old is growing year-on-year (YoY) with total enquiries up 27%.

However, as the older parts of the market mature and stabilise, we’re seeing a knock-on impact on younger EVs, let’s start with what’s going well and the impact of this.

3–6-year-old EVs

As the market matures, growth is increasingly driven by the older EVs (3–6-year-old EVs), which are opening the market to consumers who were previously priced out. Volume of enquiries in this age group have grown 50% YoY, making this the most popular age cohort and 2025’s main EV growth driver.

Overall, EVs sold every 30 days on average in 2025 – this aligns to 2024 speed and is on par with petrol cars.

But 3–5-year-old EVs? They are the fastest selling of any segment, selling every 25 days on average. The strength of demand in this part of the market is keeping pricing stable compared to the volatility in younger parts of the EV market.

What’s behind the strong levels of demand in this segment?

A growing amount of choice is key to building consumer interest; there is now a greater variety of models available and they’re being sold by a broadening group of retailers across the UK with regional coverage also improving. By the end of 2025, 80% of franchise and one in five independent retailers had stocked EVs. This growth and expansion helped to stabilise pricing movements in parts of the market.

This year, as the electric market continues to mature, one in 10 of all cars aged 5-7 years will be electric. Similarly, a quarter of all cars under 3-years-old will be electric.

As the older end of the used electric market continues to grow, confidence around battery technology will be vital to achieving mass electric adoption. Almost two thirds (64%) of consumers told us that concerns around battery health would stop them from buying a used EV, so there is more work to be done to future-proof the transition.

Now, what’s happening to the 0–3-year-old EVs?

The squeezed middle: 0–3-year-old used EVs

Demand for younger EVs increased modestly, though less than neighbouring cohorts due to market pressures at both ends of this age group - this high level of competition is resulting in slower speed of sale. As a result, prices of these younger used EVs saw increasing pressure in Q4 of 2025.

Where’s the competition coming from? Both brand new and older EVs

More affordable new EVs on the market – thanks to both the Government’s Electric Car Grant and Manufacturer offers - are pulling consumer interest in the new car market. This is helpful for Manufacturers and the ZEV Mandate but diverts interest away from the 0-3 used cohort, which in turn risks putting pressure on those selling younger used EVs.

What’s the impact of the Electric Car Grant (ECG)?

Electric interest was sluggish on Autotrader in 2025 until the ECG was announced – after which, electric share of enquiries picked up amid fierce competition and more affordable new models:

Some consumers are being pulled into brand new EVs whilst others are tempted by attractive bargains in the older age groups.

The potential risk to younger used EVs and future values

The squeezed middle, 0–3-year-old EVs, is starting to represent a growing proportion of the used car market in those age groups. Continued pressure on these electric age cohorts could see demand supply converging which could have a negative impact on price. Whilst historically this type of market movement has resulted in price declines, for example in 2023, the dynamics are now vastly different.

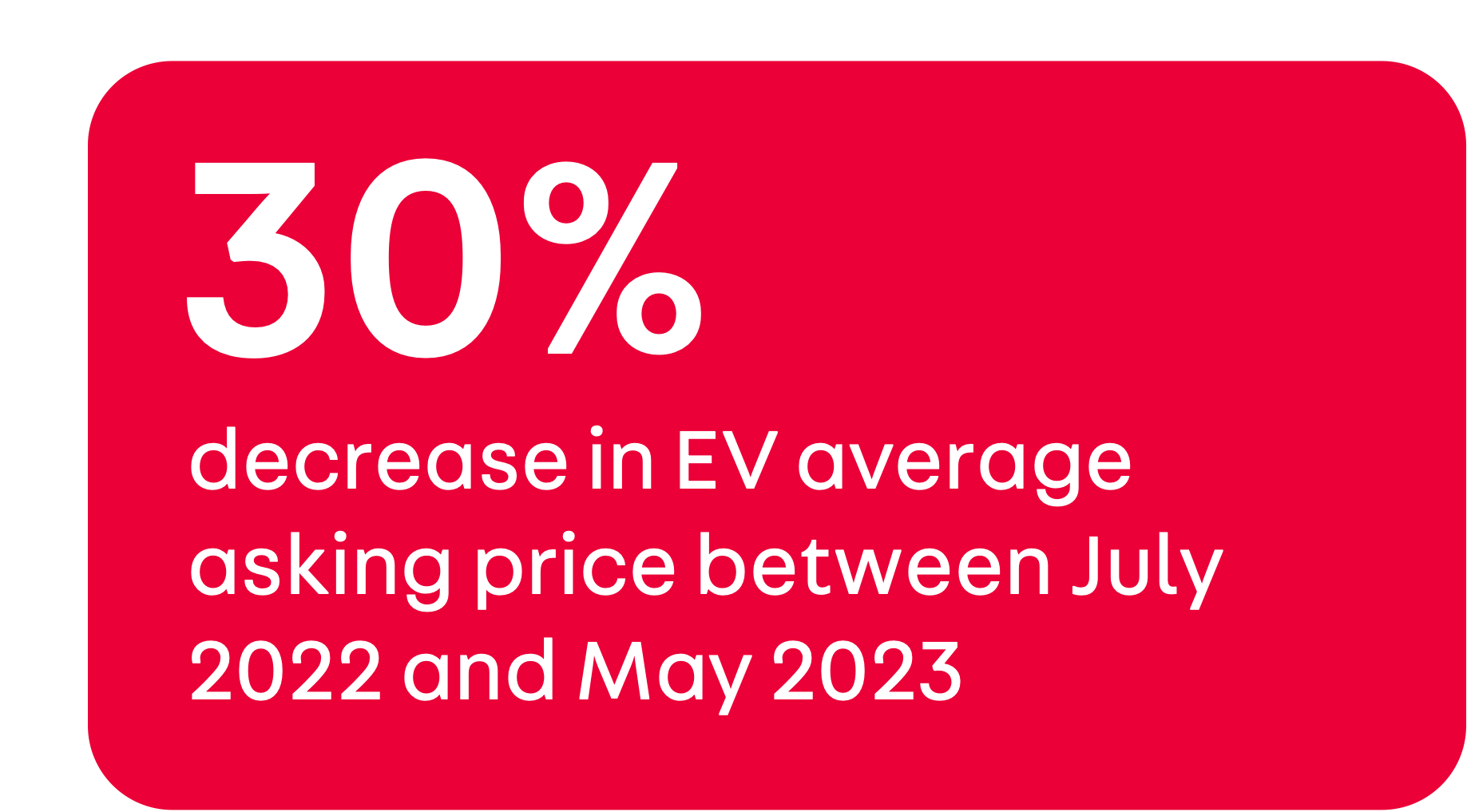

What happened in 2023?

The combination of increased energy prices and an influx of electric car supply on the extremely immature used market resulted in supply exceeding demand. The speed at which these cars were selling decreased significantly compared to the rest of the car market, prompting sellers to reduce prices. The average asking price for an EV fell by 30% in the period from July 2022 to May 2023 as demand continued to pull ahead of supply.

Why is it different now?

After the steep price drops of 2022 - 2023, the used EV market has shown early signs of maturity, as would be expected from a growing market. One key indicator of this is that speed of sale of these cars is robust and that when supply and demand dynamics are stable, monthly price movements align with the overall used car market. The expanding model choice and expansion of retailers stocking used EVs also help to bolster the strength of the used electric market and should help to avoid extreme price drops.

Looking at the current situation, recent demand pressures have seen monthly prices movements of used EVs at least 1.3ppts worse than the market in the final months of 2025.

Considering the growing maturity of the used electric market, the impact of the current demand and supply imbalance should not be as large as 2023, particularly as EVs remain the fastest selling fuel type into 2026 thanks to robust levels of demand. However, it’s still vital to stay close to the detail and remember the importance of nuance.

With nine in 10 new cars being bought on finance, and the value of the car at the end of the agreement being a key factor in the monthly repayment calculations, the price of used cars has a significant impact on how much consumers will pay for their new cars. Therefore, maintaining stable and healthy used values at the 3-4 year point is critical to new car affordability and the success of the EV transition.

As electric registrations continue to grow in the new car market, particularly through channels that see high discount vehicles returning to the used car market within three years, supply of young used EVs will continue to grow.

Crucially, demand must remain ahead of supply to remove the risk of any repeat of 2023 dynamics.

Regional differences – where is electrifying and where is being left behind?

Those in Scotland and South-West are in danger of being left behind whereas more affluent areas continue to lead the charge in the transition, highlighting an urban-rural divide in EV consideration. The median level of interest across all postcodes is 31.2%.

Data is based on the share of users which have viewed at least one EV on the site in past 90 days. Minimum 1,500 users in an area. Snapshot February 2026.

So what does the Government need to do?

What can industry do?

Manufacturers can support the younger used market and their retailer networks with compelling approved used programmes which give buyers reasons to purchase in this cohort specifically.

Retailers can use insight, tools and data to assess the local market opportunity, understand the product and how to sell it to a new wave of EV buyer. Using this data to understand valuations in particular will support with making the right decisions on what to stock and how to sell.

In summary,

the electric transition is making solid progress, but the potential risks are clear. Growing affordability provided by industry innovation alongside the Government’s Electric Car Grant is helping the new electric market, but further support is needed to support the used sector – both in addressing the upfront price barrier and concerns around battery health.

Whilst there are fluctuations within different pockets of the used electric market it’s essential for the industry to rely on up-to-date market data to make prudent stocking and pricing decisions.

There’s plenty for both Government and industry to do to ensure the momentum of the electric transition continues and grows and these next few years are vital as we continue on the road to 2030.